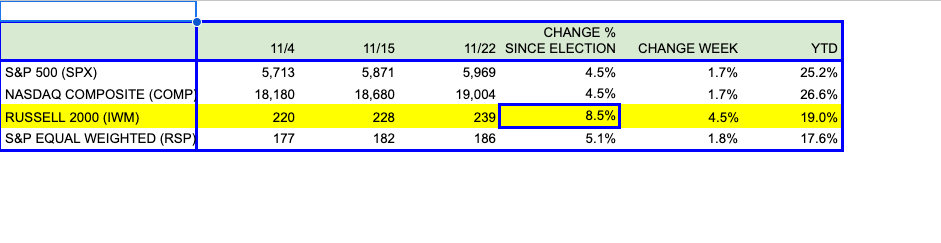

The Russell 2000 (IWM) ETF and the S&P 500 Equal Weighted Index have been outperforming the S&P 500 and the NASDAQ Composite since the election. Last week was no exception.

The IWM comprises 2,000 of the smallest capitalized companies in the market.

The IWM has gained 8.5% compared to the S&P 500’s and the Nasdaq Composite’s 4.5% gain since Nov 4th, 2024, and 4.5% in the last week, significantly higher than the 1.7% each gained by its larger counterparts.

Last week, breadth was better across the board. The NYSE Advance/Decline Ratio or $ADRN, finished on Friday 11/22 at 3.6, (3.6 stocks advancing V 1 decline), it averaged 2.29 for the past week, and 1.81 since the Nov 5th election against an average of 1.61 for the Year To Date.

Clearly, everyone wants in and has been wanting in since the election – money has shifted from chasing the M-7 and other large caps to a larger pool of small-cap stocks. The markets have aggressively seized that opportunity and have bid them faster than the large caps. Is the breadth a bullish sign or is the euphoria unsettling?

Let’s look at some of the main reasons:

Business-Friendly Populist Government: To some extent, there is a perception that small caps are closer to the economy than the M-7, and other tech behemoths, which explains why the prospects of tax cuts, pro-business policies, and less regulation would improve their fortunes much more than the large caps.

Small Caps are cheaper: Large-cap tech is also perceived to be much more expensive – the average earnings multiples are lower for small caps.

Everybody and their uncle owns Nvidia: Investors and traders are likely overexposed to big-tech stocks and need to diversify, but were afraid to do so. A Bank of America study found “Long M-7” the most crowded trade in the markets just two weeks back.

Animal spirits are up: More risk-taking, Hell the markets are likely to go up with the pro-market Trump administration and I should add. Consumer sentiment seems to have boomed since the election.

FOMO – The small caps are up and I don’t have exposure, I need to jump on this train.

Should we remain invested or does breadth call for caution?

Business-Friendly Populist Government: I agree with the tax cuts and deregulation, but we need to see if the proposed tariff plans could derail this.

Small Caps are cheaper: Small caps may be cheaper, but if you take out the premium that should go to secular growers with sustainable competitive advantages, and look at the risks associated with smaller, struggling businesses, the difference is not that stark, and sometimes it’s the opposite. Some businesses are just terrible, with no competitive advantages, and low prospects of growth, and their stock prices are driven purely by momentum. These are risky businesses you don’t want to own, period. For now, I believe this rotation may continue for a few weeks more, but the bottom line — if I’m looking at a small cap or even a small cap index, I’m going to look at the underlying fundamentals before making a call. I’m not riding any gravy trains here.

Everybody and their uncle owns Nvidia: That is true – the overownership is well documented, and when there is overownership, the scope to continue rising is much, much lower. To some extent, the earnings have to catch up with the valuation or the stock will just drift, and you’ll find large-cap investors rotating into small-caps.

Animal spirits are up: Drill, Baby, Drill, DOGE, etc, all sound great during the honeymoon period, but the jury is still out, we’ll have to see how everything works in 2025. I’m on the fence on this, it’s still a show-me story, and the possibilities of this going south are not small.

FOMO: This I am seeing first hand – For example, Navitas (NVTS) one of my weak small-cap picks, which sank from $4 to $1.60, has suddenly bounced back from the dead to $2.40 in a week! I’m not going to look a gift horse in the mouth, I didn’t add but I’m hoping it bounces back to at least where I can exit. Navitas is actually in the right place at the right time – its focus is on power saving for data centers, which could be a huge business, but it’s currently, heavily exposed to China with 57% of sales there, (it is in 60% of all the cell phones in the world). Besides Navitas, several other stocks popped in the previous week, without any changes in fundamentals.

Conclusion

Breadth is good for the market, just not at the expense of the usual due diligence.

All five reasons helped a fundamentally sound, and highly high-quality small-cap stock like Confluent, (CFLT) a favorite, that I’ve owned and written about. It’s a $1Bn revenue company with an $8Bn market cap, which shot up from $27.50 to $31.50 in the past week for several reasons.

The business-friendly and animal spirits bounce – because now enterprises seem to be spending; The halo effect from Snowflake (SNOW) the 4x larger data warehousing, market leader had a great quarter and guidance last week; Confluent, which serves the same enterprise market with data streaming is also being seen as a beneficiary and now gets the higher multiple.

The over-ownership bounce: I would rather add more Confluent and Klaviyo (KVYO) shares because my portfolio already has high exposure to large caps.

Small Caps could continue to outperform in the near term, just to catch up. As we saw from the chart, on a YTD basis they’re still behind at 19% to 25%.