IonQ -(IONQ) $8

Quantum computing is still in its infancy and a difficult and risky endeavor. The scale that quantum computing wants to achieve – 3.6 billion GPUs would be required to simulate a 64-qubit system. To do this in a commercially successful way at scale will take a lot to go right.

Several methods are competing with one another:

- Solid state is used by the likes of Google, IBM, and Rigetti Computing (RGTI) to use artificially manufactured qubits that are engineered into the system.

- Exploiting naturally occurring substrates (photons or atoms) that exhibit quantum properties. This method is used by Quantum Computing (QUBT)

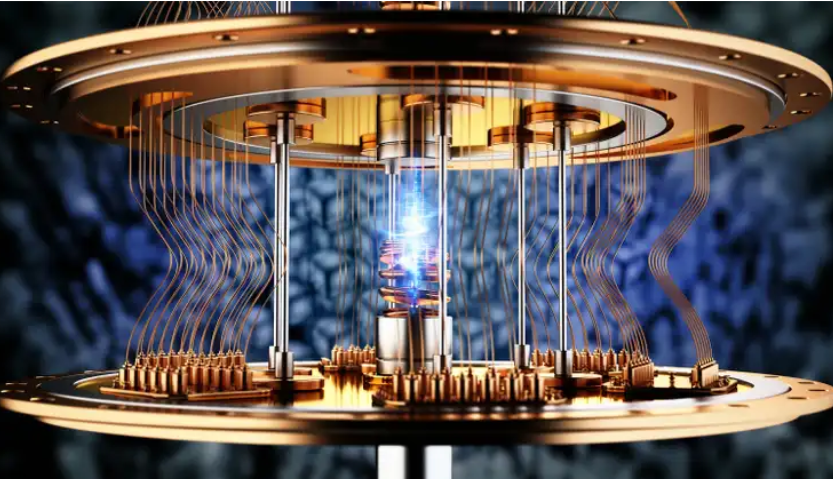

- Trapped atomic Ions – IonQ’s methodology uses trapped atomic ions as qubits to construct quantum computers.

None of them have had much commercial success, but are seeing orders and bookings.

IonQ – has a $ 25Mn grant/order from the US Air Force.

Total revenues for 2024 = $42Mn and 2025 = $82Mn

Achieving the 64-qubit system in 2025 is a must-reach milestone for IonQ, simply to have a shot at commercialization or even survival.

The big negative besides the commercialization risks is that the two founders have left – for academia, though not for competitors.

It has cash of $460Mn so will survive through 2027.

No system has achieved a broad quantum advantage – where developers prefer quantum computers to traditional ones – it could be three to five years on the horizon/ or not at all

Quantum wants to combine GPUS, networking, and AI, but hardware and software innovations have to produce systems economically at scale, as well as demonstrate to enterprise-level customers why it needs a quantum computer.

A LOT OF IFS — of competing systems, need to preserve cash, race to innovate, race to scale operations, and do we even need quantum computing?

Bottom line – this is like a biotech or a drug discovery bet, high risk/high reward.