Fed rate cut not likely in March

Inflation has eased from its highs without a significant increase in unemployment— “that is very good news,” Federal Reserve Chair Jerome Powell said Wednesday after the central bank kept its policy rate unchanged for the fourth straight meeting. But he followed that up with inflation still remains above the Fed’s 2% goal. “We need more evidence to confirm what we think we’re seeing,” Powell said.

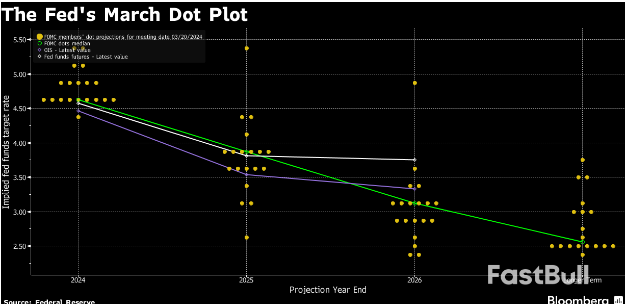

It will likely be appropriate to dial back the Fed’s policy rate at some point this year, he said.

Powell repeats that the Fed will move “carefully” in considering when to cut rates. He doesn’t think that the FOMC is likely to cut at the March meeting.

While he sees some risk that inflation reaccelerates, “the greater risk is that inflation will stabilize at a rate over 2%.”

He declined to say the economy has achieved a soft landing. “We’re not declaring victory at this point. We have a ways to go.”

“There was no proposal to cut rates,” Powell said. Some members did discuss their rate path. Also, he said there was a broad range of views.

“If we saw an unexpected weakening in the labor market, that would weigh on cutting sooner.”