Nvidia Announcements: Jensen Huang CEO delivered the CES (Consumer Electronic Show) keynote on January 6th, 2025. An immensely popular event, with about 140,000 attendees, the charismatic Jensen drew a packed crowd. Jensen did not disappoint.

New Gaming Cards: Nvidia’s new line of RTX 50 Series gaming graphics cards is based on the company’s Blackwell chip architecture. Considering the massive leap Blackwell has made over Hopper, its previous iteration in data center applications, getting it to work in gaming is a huge deal – a massive improvement with superior rendering and higher frame rates for gamers.

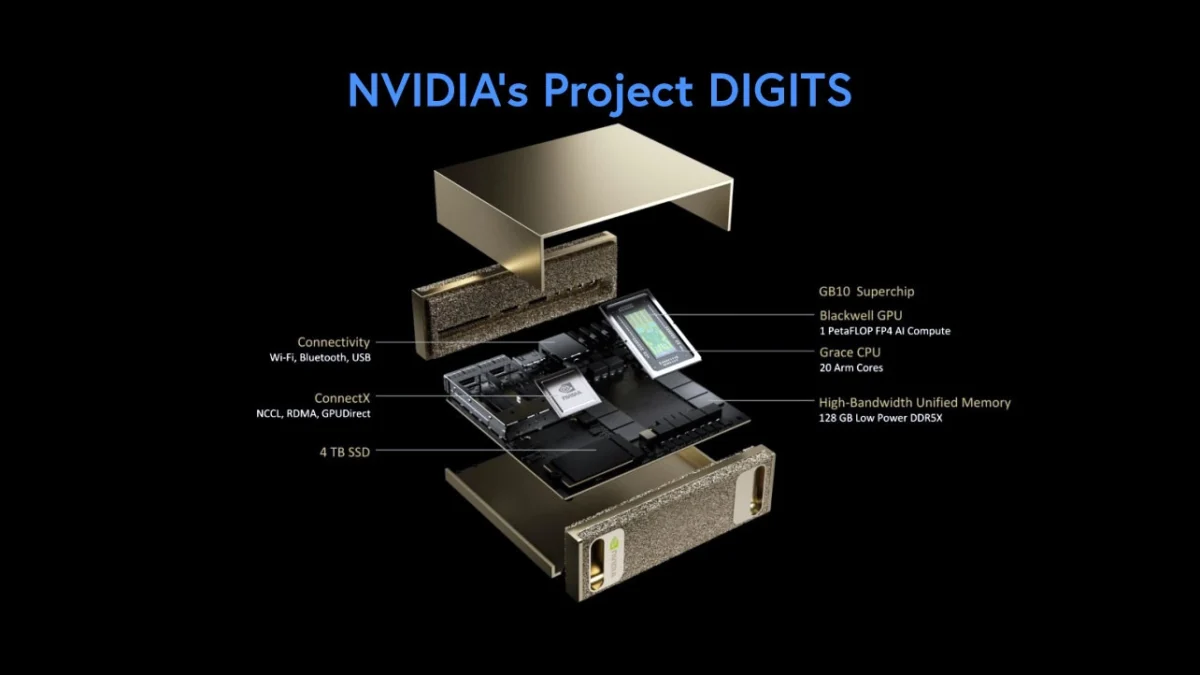

Digits – The Linux-based desktop computer with the GB 10 Grace Blackwell Superchip with a CPU and GPU. A first in its history at $3,000 “Placing an AI supercomputer on the desks of every data scientist, AI researcher, and student empowers them to engage and shape the age of AI,” Huang said.

It may seem like a niche product for high-end engineers/professors/scientists and researchers, but I think it’s a deliberate and excellent strategy to evangelize the product, through the folks who can develop use cases and apps that can further the market for cheaper at scale mass Digits in the future.

This is straight from the Nvidia playbook from the last two decades – they have always involved the scientific and research community from the start. I can bet a large number of these are going to be distributed free to campuses.

I think Digits will turn out to be a very consequential product for Nvidia – with several billion in revenue in a few years. But forecasts aside, what’s key is that Digits uses a scaled-down version of Nvidia’s Grace AI server CPU technology. It’s packaged in a Mac Mini-sized form factor with the help of Taiwan-based MediaTek, which Huang commended for its expertise in building low-power chips.

Quoting Tae Kim from Barron’s who authored an excellent book on Nvidia.

“Over time, the logical move for Nvidia would be to scale down this CPU further for consumer Windows laptops. By integrating its graphics expertise, MediaTek’s power-saving capabilities, and the efficiency of Arm-based CPU technology, Nvidia could create a processor that offers leading graphics for gaming and high performance for productivity, along with long battery life. While prior Arm-based Windows PCs have struggled with software compatibility, Nvidia’s top-notch software engineering could make it work.”

Huang strongly hinted it was likely to happen. “We architected a high-performance CPU with [MediaTek],” he said on Tuesday at a question-and-answer session with financial analysts at CES. “It was a great win-win.”

When pressed by an analyst if Digits was an iterative step toward moving into the PC market, “I’m going to have to wait to tell you that,” Huang said. “Obviously, we have plans.”

There are questions about why Nvidia chose Linux over Windows – and we should hear more about that at their GTC conference in March.

It could shake up the moribund PC market, which has been suffering from a lack of growth rates after COVID-19. Desktop PCs and laptop computers still generate large revenues for Intel and Advanced Micro Devices, the primary makers of x86-based processors – a legacy that could give way to ARM-based processors, which Apple uses. Analysts expect Intel to generate $30 billion in revenue from its client computing business in 2024, according to FactSet, while AMD has $6.7 billion in revenue in its client segment.

Billions of potential new revenue are at stake for Nvidia, which is forecasted to make $180Bn in sales in the 12 months ending January 2026. While data center takes up the largest share of revenue at about $150Bn of that pie and gaming, auto, and professional visualization (Omniverse) take the rest, a new source would help a great deal when data center revenue growth slows down.

In the past two years, Nvidia has monopolizedized the AI data center market with the best-designed, highest-performing chips. Nvidia would likely make a significant dent in the PC market as well as the new paradigm in edge computing with all the computing power and constant innovation and upgrade at its disposal.

The third announcement was for COSMOS – a significant improvement over their Omniverse and the biggest catalyst/enabler of “Physical AI”, I’ll write a separate note on that.

Nvidia wants it all. That’s likely to be good news for consumers and trouble for the PC status quo.