Comment made on the SA article.

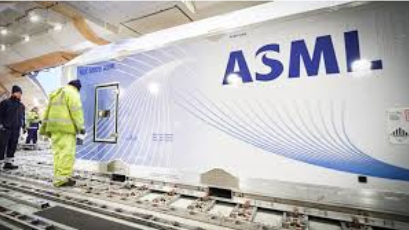

ASML – Lithography, Monopoly in EUV machines, each machine costs north of $200 Mn, absolutely vital for lower node semis like 3nm, which is powering the latest I-phone among others.

ASML is at the pole position since it’s a critical component for AI and/or high-end chips. Every chip being planned or in production for AI acceleration or incorporating AI acceleration is produced on a 5 nm or smaller node that requires EUV

They also have the lower-end D-EUV machines, which are also successful.

Here’s a good link to the equipment technology market.

Lam Research on the other hand is strong in Etch and Deposition, which is exposed to cyclicality because it’s more of a mass market commodity with competition for AMAT, KLAC, and Tokyo Electronics. But the pickup from customers like Micron, which itself is riding the AI boom for high-grade memory equipment is a big benefit for Lam. To me the biggest strength is the resilience in the last 10 years with an EPS CAGR of 28% – that is a huge deal, cyclicals/commodity producers never get that.