February Jobs Report

Net job gains 275K, higher than the 200K expected.

Hourly wage gains 0.1%, lower than 0.2% expected.

The two-month payroll revision, though, shows a 167,000 loss

The Unemployment rate rose to 3.9%

The 10-year treasury yield, which started at 4.09 is at 4.05

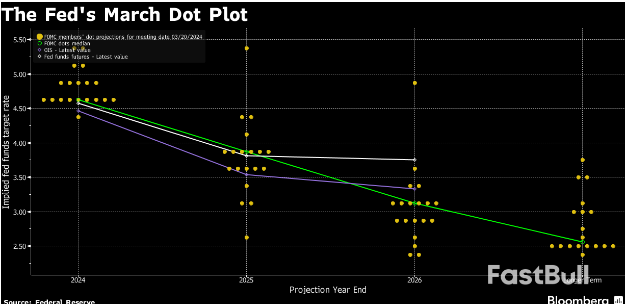

Yesterday, Powell indicated – Fed ‘not far’ from confidence to cut rates