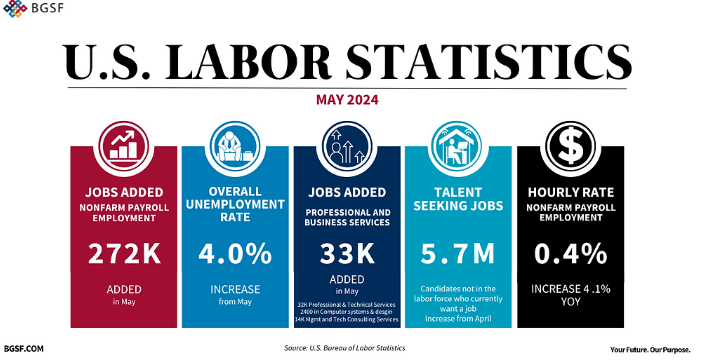

US Payrolls Rose by 272,000 in May, smashing Estimates of 180,000

The wage gain is also strong, at 0.4%, double the pace of the average hourly earnings advance of the previous month.

The unemployment rate is up, though, that’s as the labor force participation rate fell — unfortunate news for the Fed.

- May nonfarm payrolls: +272K vs. 182K expected and 165K prior (revised from +175K).

- Unemployment rate: 4.0% vs. 3.9% expected and 3.9% prior.

- Average hourly earnings rose 0.4% in May, accelerating from 0.2% in April and topping the 0.3% consensus. Y/Y, average hourly earnings increased 4.1%, compared with the +3.9% consensus and +4.0% in the prior month (revised from +3.9%).

- Futures are down 0.4% and the 10 Year treasury yield has increased 13 points to 4.43%