I’m sure you’ve been inundated with opinions on domestic politics, which is not usually a subject of this investing group. But politics is likely to affect our investment decisions so a note highlighting its impact on business is important.

So far, at, 5,994 the S&P 500 is up 5% from the Nov 4th close of 5,713, and from the forecasts of the likes of Goldman Sachs – we should be crossing 6,300 easily in 2025. Other forecasts have higher targets and we are seeing some of the traditional post-election bounce, a lot of short covering, lower volatility, FOMO, and so on…. It is a good time to be invested now.

There are a few policy areas that will affect equities.

Taxes – A big positive: The 2017 Tax Cuts and Jobs Act was due to expire on December 31, 2025. It lowered corporate and business income taxes, which was a big positive. The Biden administration was lining up a new set of “tax the rich” proposals, which are now dead. Given the proclivity of the new administration, we should see lower taxes.

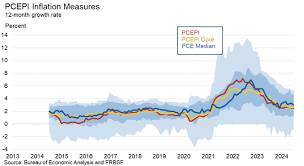

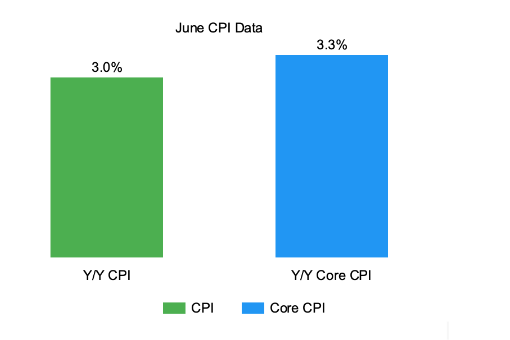

Tariffs – A big negative: but could be mitigated: THESE WILL BE HIGHLY INFLATIONARY

The Trump administration could impose tariffs at will by executive order, which is disastrously high. As part of an overall policy to rebalance trade with nations such as China, the tariffs will try to level the playing field.

According to some of the administration’s policy papers, which are part of Project 2025, – granting MFN (Most Favored Nation) status seems to have resulted in chronic U.S. trade deficits with much of the rest of the world, at the expense of American manufacturing; an unfair practice with systemic trade imbalances serving as a brake on GDP growth and capping real wages in the American economy while encumbering the U.S. with significant foreign debt.

This administration will point out China’s quest for global dominance, via protectionism, dumping, and so on, which though debatable, will be the bedrock of its tariff policies. (Who doesn’t love China bashing) The US is on the back foot regarding manufacturing and regardless of whether it is even feasible to reverse overseas manufacturing – this administration will go after it with a vengeance and tariffs will be their biggest tool to get manufacturing jobs back in the US. Tariffs ranging as high as 60% on Chinese goods, a 20% blanket tariff on all imports, and a 100% tariff on automobiles made in Mexico are possible impositions. THESE WILL BE HIGHLY INFLATIONARY

Regardless of the eventual tariffs, they’re bad for some of America’s biggest companies such as Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT) that rely on Chinese manufacturing for hardware products.

When Trump first imposed tariffs on Chinese goods, he made exceptions for certain consumer goods such as smartphones. Whether that will happen again is unclear.

Besides, we have not even talked about retaliation from global competitors to whom America exports goods and services.

Even as I anticipate tariffs to be a big negative, I’m hoping that wiser counsel prevails or perhaps the stock markets will swoon, which is reportedly a huge factor in this administration’s decisions, and not something they can control. Ironically, a stock market swoon may be the biggest reason for keeping tariffs under control.

Export controls: Some of it is already happening and is unlikely to get worse.

US technology with military applications is already banned from export. But if all exports of US-designed and engineered semiconductors, even those for consumer applications are banned it would hurt Apple, Nvidia, and Microsoft. But it would also hurt the trade imbalance that the Trump administration seeks to correct. Very unlikely.

ASML’s (ASML) EUV lithography machines could be a target if the Dutch government complies with restricting sales to allied countries such as Korea, Taiwan, and Japan. Again, unlikely.

Antitrust regulation: Positive for the markets – Under Biden, the government had lurched left, even trying to emulate the EU’s Digital Markets Act. The new administration will likely curtail some of the regulatory excesses, but we’ll have to wait and see if they try to undo recent antitrust litigation against Google (GOOG) and Apple.

Environment, energy, and inflation: More domestic drilling could be a positive, as more domestic oil reduces the need for imports, lowers gas prices, and could result in lower inflation. Its too early to comment on environmental policies and I’ll update at a later date.

Mass Deportation – Highly inflationary, when one finds it difficult to fill jobs that Americans are not willing to do. Again – I believe it to be more rhetoric and not likely to be administered en masse, I suspect this could be cosmetic.

For sure, we live in interesting times and the next 4 years should be a roller coaster.