The 2% Fed target is a myth and highly unlikely to be achieved. Historical CPI has been closer to 3%, and given the move away from globalization, and China decoupling in the past 3-4 years, that era of persistent disinflation is likely to be over. You saw Japan’s move.

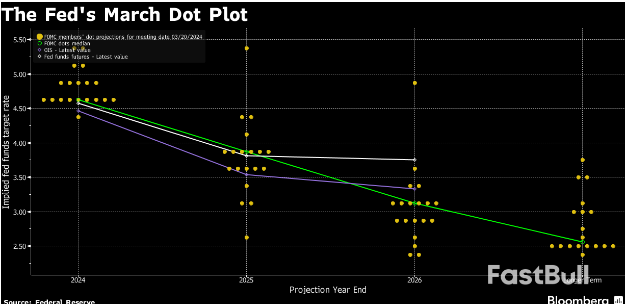

That said – At least, I believe that beyond a certain point Fed induced higher interest rates will not name inflation, a lot of US inflation is fiscal, not monetary, the Feds know that and will cut for sure as insurance – nobody wants to derail the economy. I still think the three cuts of 25% each in 2024 are achievable. But to your point, yes, I don’t think we’ll go below a 3.5% treasury for a long, long time. I agree with energy stocks doing better in 2024, they will take up more space in the index.