Summary

- I’m downgrading my S&P 500 January Buy call to a Hold because of several negative indicators, including the massive tariffs levied on April 2nd.

- While I had estimated an initial drop to 5,500, I’m reducing my lower target further to 5,000.

- Caution and capital conservation now take precedence over growth.

- Tariffs, inflation, weakening business sentiment, investor anxiety, and uncertainty remain significant concerns impacting the market outlook.

In January 2025, I wrote an optimistic article recommending a Buy on the S&P 500 (SP500), (NYSEARCA:SPY), citing a still resilient economy, earnings momentum, AI optimism, and the re-emergence of animal spirits, trumping the negatives of tariffs, inflation, and uncertainty over government policies and immigration controls. But I also mentioned that we would likely see the index touching 5,500 before moving upward to 6,500. I’m now lowering targets even further to a possible 5,000 on the lower side with a recovery to 6,000 by the end of the year – essentially flat on an annual basis for the 1st year of the Trump presidency.

What Has Changed?

These are why I feel that the correction will likely lead to a possible bear market drop of 20%.

- The worldwide tariffs imposed on April 2nd.

- The sharp drop to a 10% correction in just 21 days.

- The feeble bounce back running into a strong 200 DMA resistance.

- Weakening economic indicators.

- The weakness in the M-7.

- Escalating trade tensions.

- Lower earnings could lead to lower multiples.

- Stagflation prevents the Fed from lowering interest rates.

The April 2nd Tariffs

The Trump administration imposed tariffs on our trading partners and nations across the world, in an effort to bring manufacturing back to U.S. shores.

Tariffs went up across the board, based on calculating the trade deficit with each nation and dividing it by 2, as a “Discount”. Here’s an example – China exported $438 Bn to the U.S. last year, but imported only $143 Bn, giving the U.S. a trade deficit of $295 Bn or 68% of $483 Bn; therefore, China’s tariff rate was calculated at 34%. The same formula was derived for each trading partner, with a minimum of 10%. Here is the complete list.

According to Deutsche Bank economists, the average tariff rate on U.S. imports would go up from 9% to a range of 25% and 30%.

As of writing, the S&P is down 3.57% to 5,469, 11.4% from its high of 6,147, in firm correction territory and, in my opinion, heading to a bear market drop of 20%.

While the tariffs were created to bring more jobs back to the U.S., by inducing exporters to set up plants in the U.S., that would take a decade, in my opinion, and a significant amount of Capex, subsidies, and private-public partnerships.

For example, TSMC (TSM) is estimated to have spent up to $65 Bn on its Arizona plant, which took about 5 years to get running and included about $6.6 Bn in Chips Act subsidies, and $5 Bn in loans. Secondly, it would be extremely difficult and expensive to make products like the iPhones because we’ve lost the process manufacturing expertise. The iPhone was designed in the U.S. but made in China by Foxconn with chips from TSM – from 2008 to 2025, which is 17 years of process manufacturing expertise that the U.S. will find difficult to regain at a reasonable price – It took India close to 5–7 years to get some of the iPhone manufacturing right, and that too under Foxconn control.

In the meantime, the U.S. consumer is likely to get an additional inflation shock of 1.5%, which could tip the country into a recession.

The Sharp Drop

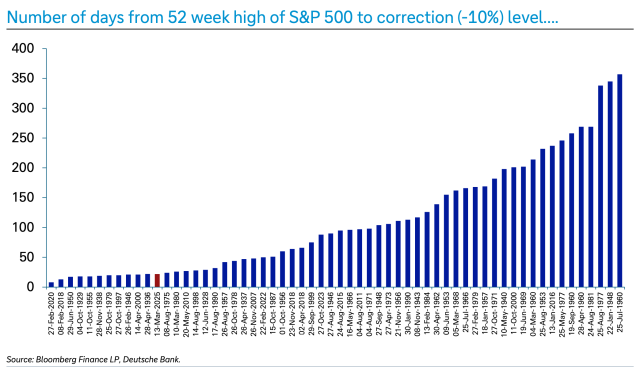

The market dropped to 5,504 on March 13th, a correction of 10% from its February 19th top of 6,147, in an amazingly short span of just 21 days. At 6,147, the S&P 500 had made a double top compared to the previous high of December 6th of 6,099, which itself should have been a warning of the market topping out. The sharpness of the drop made it the 11th fastest in history.

Here are the 59 corrections, and not surprisingly, the COVID-19 correction was the fastest. It does show weakness in being in the same bracket as a COVID-19 correction. The sharp drop denotes price action that reflects far too much anxiety and uncertainty from investors, especially when economic news hasn’t been comparably terrible. The last payroll report showed us at just 4.1% unemployment, which is close to full employment, and yet skittish investors drove the market down 10% in just 21 days!

The Bounce Back Had No Backbone

The feeble bounce back ran full tilt into a strong 200 DMA resistance line and fell like a rag doll.

I believed that the market was oversold, and it did recover for about a week, with at least one of the catalysts being the Nvidia (NVDA) GTC annual conference. I suspect another catalyst was the hope of less onerous tariff announcements. However, it ran into strong resistance at the 200 DMA line, getting to 5,776 on March 25th, as we can see below, and slid back in a few days, ending the month lower at 5,612. With the reciprocal tariff announcements on April 2nd, the index has failed to hold the 10% correction line and is down 11.4% as of writing.

Weakening Economic Indicators

I believe the soft indicators will eventually show up in the hard lagging data, such as unemployment, payrolls, and GDP reports:

I find the soft indicators of surveys and polls extremely useful, especially when a majority of them are moving in the same direction as they did in February and March. For someone like me who is heavily weighted towards high beta stocks, such as the Magnificent Seven, semiconductors, cyber securities, or fast growth stocks, they are a good warning sign of impending trouble. It gives me a chance to de-risk, which I did and saved about 15-25% by selling portions of my portfolio. It turned out to be a good hedge.

Small Business Survey

In a March 27th article, Barron’s reported pessimism among small businesses, citing the Fed’s small business survey; I strongly believe that this manifests in weaker employment and slower GDP growth from Q2-2025.

Small businesses, classified as fewer than 500 employees, are the biggest employers in the country, accounting for almost 50% of America’s workforce, and about 43% of the country’s revenues or GDP.

There is a wave of pessimism around this cohort for several reasons, mainly,

- Uncertainty over the passage or renewal of the tax cuts of 2017.

- Rising cost of production

- A lack of clarity over tariffs and labor.

- Delays in planning and budget outlays are expected because of these uncertainties.

Crucially, this cohort has lost the post-pandemic recovery momentum with revenue and employment stagnation and decline. Worse, it has added debt in 2024 to tide it over.

In 2024, more small businesses reported their revenues decreased (41%), than those that saw an increase (38%). That’s the first time that has occurred since 2021. Profitability was a bit better, with 46% of small businesses reporting they operated at a profit in 2024.

From the Fed Small Business Survey

“Small businesses, because of the uncertainty, are starting to feel the squeeze,” says Tom Sullivan, the chamber’s vice president of small business policy. Owners are not “poised for growth,” which Sullivan says is concerning, considering small businesses are a primary job and innovation generators within the U.S. economy.

The University of Michigan Sentiment Index

The March 14th reading was abysmal. Coming in at 57.9, 5.1 points below expectations of 63, it was a whopping 6.8 points below the previous month. The biggest contributors to the angst were:

- The rollercoaster of stomach-churning tariff changes and economic policies.

- High inflation expectations of 4.9% – the highest since 2022.

- Worse, long-run inflation expectations rose 3.9% from 3.5% in the previous month, a monthly jump not seen since 1993.

From the director of consumer surveys at the University of Michigan, Joanne Hsu:

Many consumers cited the high level of uncertainty around policy and other economic factors; frequent gyrations in economic policies make it very difficult for consumers to plan for the future, regardless of one’s policy preferences.

Stagflation – Higher Inflation and Lower Growth

During their March 19th meeting, the Federal Reserve, while leaving their benchmark rates unchanged, made three key changes from their January meeting estimates.

- Inflation expectations rose from 2.5% to 2.7%

- GDP estimates lower from 2.1% to 1.7% – that is a large decline.

- The unemployment rate was revised to 4.4% from 4.3%

Stagflation hurts at both levels, and also hamstrings the Fed from reducing rates fast enough to revive the economy if GDP and employment falter.

The tariffs levied as of April 2nd will likely increase inflation by another 1.5% and reduce GDP growth to 1%.

Weakness in the M7

The Magnificent 7 stocks, which take up the lion’s share (31%) of the S&P 500 index and are a ubiquitous presence in our lives, have fallen like nine pins in this quarter. All of them are down over 20% from their 52-week highs, with Tesla (TSLA) leading the pack at 46%, followed by Nvidia at 33%. Everyone sells their family jewels last, and if the carnage is engulfing the best and the brightest, I think the S&P 500 will take a while to regain its footing.

Escalating Trade Tensions

Far from trade and tariffs being resolved through peaceful bilateral trade negotiations among business partners, the constant refrain coming from trade partners, friends, and neighbors has been one of disappointment and disgruntlement. Here are a few examples of where this is heading.

From Japanese Prime Minister Shigeru Ishiba, after the U.S. turned down personal appeals not to levy 25% tariffs on auto exports:

What President Trump is saying is that there are both friends and foes, and friends can be more difficult. This is very difficult to understand.

A diplomatic answer, but a firm one, which has now led to trade meetings between South Korea, China, and Japan, an unthinkable proposition a while back.

And neighboring Canada has retaliated. From Doug Ford, the pugnacious Ontario premier.

I’ve spoken with Prime Minister [Mark] Carney. We agree Canada needs to stand firm, strong and united. I fully support the federal government preparing retaliatory tariffs to show that we’ll never back down.

And this is after April 2nd, with China leading the pushback:

The tariffs “violate international trade rules, severely infringe the legitimate rights of relevant parties and represent a typical act of unilateral bullying,” the department said in a statement translated by The Wall Street Journal.

I believe trade tensions will continue, disrupting the global economy.

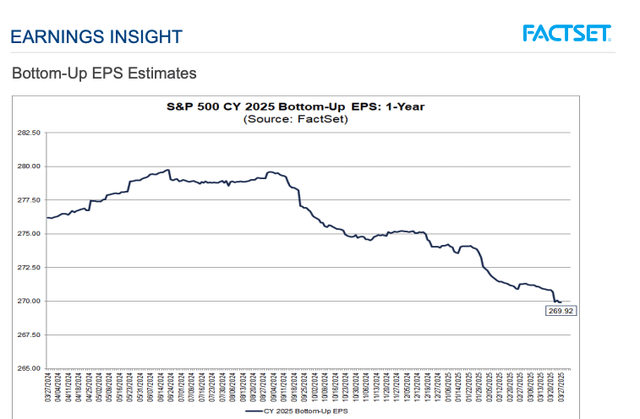

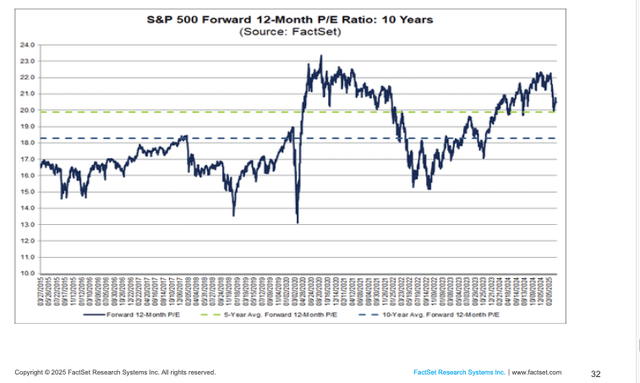

Lower Earnings and Growth Could Lead to Lower Multiples

The latest report from FactSet shows that S&P 500 2025 earnings estimates have dropped from $280 per share to $270 per share and are trending lower.

Further, even after the 10% correction, the S&P 500’s P/E ratio has barely touched the 5-year average of 20. And to everyone, the average of 20 had two positive components: corporate revenue and earnings growth, and lower interest rates. Now, with earnings declining, and the 10-year treasury yield over 4.2%, the P/E will veer towards the lower 10-year average of 18.2. Multiples always compress in tough times, and I don’t expect this time to be an exception.

Goldman Sachs went even further, dropping their GDP outlook to just 1%, inflation to 3.5%, and increased unemployment estimates to 4.5%. Clearly, they too want to get ahead of it and have even lobbed in a dreaded recession estimate of 35%. I expect more to follow.

Stagflation Prevents the Fed From Loosening

On March 28th, the Core CPE – the Fed’s preferred inflation gauge inched up a little more than expected at 0.4% MoM versus the 0.3% consensus. It was also a tad higher than January’s 0.3%. That translated to an annual increase of 2.8% vs the 2.7% estimate. It, too, was slightly higher than the previous month’s gauge of 2.7%.

The CPE, which increased 0.3% MoM and 2.5% YoY, matched both monthly and consensus estimates.

Personal Savings grew as personal income exceeded personal spending!

Personal income grew +0.8% M/M, vs the 0.4% estimate, and beat the previous month’s 0.7%. It dwarfed personal spending, which only grew 0.4% MoM, thus allowing the personal savings rate to grow to 4.6% in Feb, V 4.3% in Jan. In a growing or steady inflationary environment that we’ve been seeing for the past years, it becomes exceedingly difficult for the Fed to lower rates when needed, without stoking inflation.

The Strategy For The Rest Of 2025

Coming back full circle, there are far too many negatives to ignore and just ride the AI train, which rewarded me very well for two years, and it would be more prudent to play defense, conserve capital, and raise cash. I think Warren Buffett’s $334 Bn cash hoard is telling us something.

As I mentioned in my last article, two years of 23% sequential gains have happened only 3 times in a century. The chances of a reversal or a stagnant market in 2025 are extremely high; thus, caution would be the biggest objective and strategy.

My portfolio is tech-focused, I’ve been taking profits on tech stocks intermittently, raising cash and diversifying into ETFs, consumer staples, defensives, and also looking at global indices.