Playing defense. I’m going to add dividend / income generating defensive stocks/ REITs to diversify from semis and tech.

REITs are structured to invest in property and distribute income as dividends to shareholders. They often work well as defensive, less volatile income generating vehicles and its worth owning some.

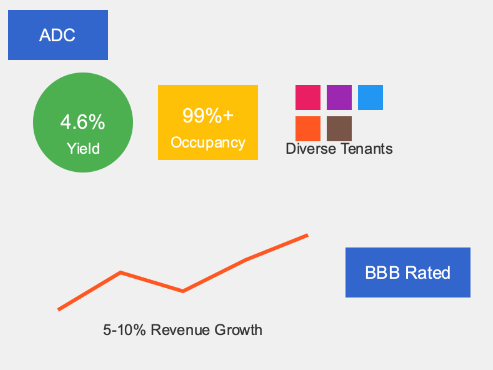

Realty Income Corporation (NYSE:O)

- Long dividend growth track record, maintains a top-tier balance sheet.

- High exposure to investment grade tenants.

- Lower leverage profile than peers, with small and manageable near-term debt maturities.

- Less bottom-line drag from refinancing maturing debt at higher interest rates.

- Realty Income appears to benefit from its A- credit rating.

- 0.8% same store rental revenue growth, a solid number for the industry.

Risks

Tenant Red Lobster filed for bankruptcy but is only 1% of volume.

The REIT is down 7% for the past year but has recovered from its low of $45.

The main fear with REITs/Dividend stocks – while dividend growth and dividend yields are attractive, its essential that the stocks at least remain flat otherwise pocketing the dividend and losing it in the share price is meaningless! We must be careful to not overpay.