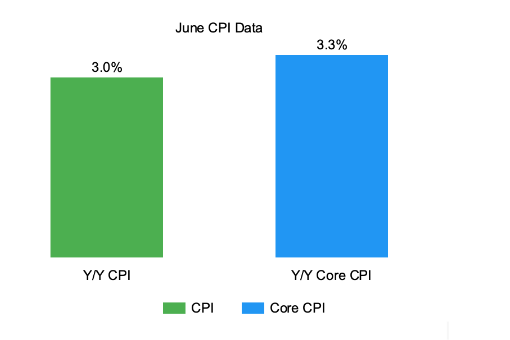

CPI continues to cool in June, with core Y/Y rate easing to +3.3%

- June Consumer Price Index: -0.1% M/M vs. +0.1% expected and 0.0% in May.

- +3.0% Y/Y vs. +3.1% expected and +3.3% prior.

- Core CPI (excludes food and energy): +0.1% M/M vs. +0.2% expected and +0.2% prior.

- +3.3% Y/Y vs. 3.5% expected and +3.4% prior.

The 10-year yield has dropped to 4.27% and S&P 500 futures are up 0.3%.