I’ve been adding Amazon (AMZN) to my portfolio in the past week; it is a bargain at $202, having dropped almost 20% from its high of $242.

Amazon has 4 businesses.

Amazon Web Services

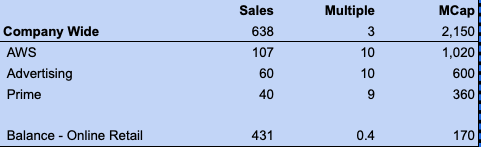

AWS is a cloud services behemoth and market leader with $ 108 Bn in 2024 sales, and still growing at 19%. That is remarkable growth for a market leader of that size with two other 800-pound Gorillas, Alphabet and Microsoft, chasing it. It generated operating profits of $39 Bn last year, a growth of 66% with an operating profit margin of 37%. This is Amazon’s most profitable segment and the growth engine, which powers everything.

Advertising

Amazon includes its advertising revenues in the online retail sales segment, but its advertising revenue last year was estimated between $ 56 Bn to $ 64 Bn in 2024, growing around 20% a year. This is also a high operating margin business, generating over 20% in operating profits.

Prime Subscriptions

Amazon doesn’t disclose its Prime subscriber numbers, but we estimate about 200Mn subscribers, including 180Mn in the US in 2024, generating over $40Bn in revenue.

This is another sustainable, sticky, and high-margin business, I’d value it at about 9x sales or $360 Bn.

I used a 9-10x multiple for the high-growth, high-profit margin, and sustainable businesses.

Online and physical retail sales in the US and abroad

These include third-party sales. Physical sales revenues are minuscule compared to total retail sales; loss leaders to expand reach and for analytic purposes, including in the online retail business. Amazon had a whopping $ 431 Bn in 2024. While online domestic and international sales are a drag, growing slower in single digits, they’re not significantly slower than Walmart’s sales growth and margins.

Based on the Sum of the Parts schedule above, we’re getting the online and physical retail operations of $431 Bn at a market cap of just $170 Bn. The multiple of 0.4 is much lower than Walmart’s multiple of 0.74, or 40%.

Amazon has been spending heavily on Capex for AI to gear AWS and expand its web service offerings. In this arms race, they are scheduled to spend $100 Bn in 2025 to maintain and possibly expand their leadership.

We haven’t even valued all their investments and partnerships under AI development. That can be very valuable in the future.

I’d continue to buy the stock on declines.