Apple, (AAPL) – $170 Hold

The recent drop, especially today, has been because of weak iPhone sales in China, which fell 24% year-over-year in the first six weeks of 2024, amid rising competition from Chinese rival Huawei Technologies, Counterpoint Research said. There’s a lack of consumer confidence in China, and several attempts to kickstart their economy have not succeeded; If it goes into a deflationary spiral, this problem could continue for a few quarters before bottoming out.

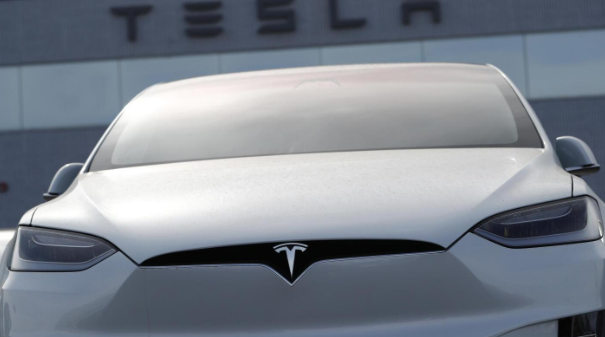

Getting out of the car project was a good idea, even if they wasted a decade and billions of dollars, but that’s no longer a drain, and diverting that to AI development is absolutely necessary, even if it is a little late.

The stock should remain sideways and sluggish for a while, but this is not a trading stock, it’s a long term investment, which doesn’t quite give blockbuster returns but is a steady performer. I’m not planning to sell any and will revisit if it falls further.