I sold 15-25% of several stocks on Friday, 02/21/2025 as a de-risking exercise in the wake of weakening economic indicators, which I wrote about in this article.

Here’s the list and you can see them in the Trade Alerts Section as well.

ARISTA NETWORKS (ANET) $101

ADVANTEST CORP SPON ADR (ATEYY) $63

AMAZON INC (AMZN) $218

APPLIED MATERIALS INC COM (AMAT) $174

APPLOVIN CORP COM CL A (APP) $430

ARM HOLDINGS PLC (ARM) $147

BROADCOM INC COM (AVGO) $222

DOORDASH (DASH) $201.65

DUOLINGO INC CL A COM (DUOL) $410

DUTCH BROS INC CL A (BROS) $80

GITLAB INC CLASS A-COM (GTLB) $65.75

KLAVIYO INC (KVYO) $42.75

MICRON TECHNOLOGY INC (MU) $101

NETFLIX (NFLX) $1,012

SAMSARA INC (IOT) $54.25

SPOTIFY TECHNOLOGY S.A. COM (SPOT) $626

Earnings alone won’t save this market from a correction

Earnings season for Q4-2024 is mostly over except for Nvidia (NVDA), which reports on 02/26. M-7, and overall earnings were mostly lackluster and while most beat sandbagged estimates as always, the beats were nothing to write home about.

Instead, there was a lot of pressure for Q4 earnings to outperform to trump bearish indicators such as stubborn inflation, high valuations, tariff uncertainty, the likelihood of no interest cuts in 2025, difficult housing markets with 7% mortgage rates, weakening consumer sentiment, and so on….

Analysts, according to FactSet are still forecasting an estimated $268-$275 in 2025 S&P 500 earnings (about 11.5% growth), but this number seems more and more likely to either come in at the lower end or be revised lower as the year progresses. Second – the two-year back-to-back gains of 23% are a historical anomaly so I have to keep that in mind of a likely down year or a flat to 7-8% gain from already high levels.

Against all that is the $320Bn in Capex from the hyperscalers (That’s real money, not an economic survey or estimate – therefore the strongest catalyst ), which is extremely good for the AI industry and a very strong and vocal belief in the fundamentals – longer term we are on solid footing, and the AI story is just beginning, there are a lot of benefits to reap.

Active Risk Manangment

In short – a balancing act, which means there has to be active risk management. And especially when almost all the economic indicators came worse than expected, with sticky inflation and slower growth – stagflation. The Michigan survey of inflation expectations is followed closely by the Feds, and the weakening PMIs coincide with Walmart’s lower guidance. The reports have a lot of meat and don’t paint a pretty picture.

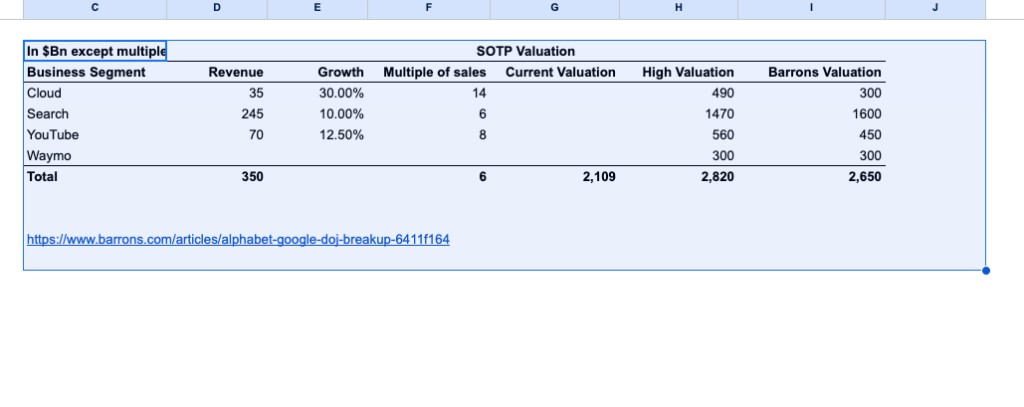

I’m not selling/trading the index or the stalwarts like Apple (AAPL), and Alphabet (GOOG) – there will be a flight to quality, thus not recommended. Even with a correction I don’t see the S&P 500 falling beyond 5,600-5,780. 5,780 was the Nov 5th election day level, that’s just 3.8% lower, not worth it.

My portfolio is tech-centric, and sometimes the drops in those are between 20% and 30% – AppLovin (APP), Palantir (PLTR), and Duolingo (DUOL) are examples, plus they’ve performed far better than expectations so taking some off is a great de-risking strategy for me.