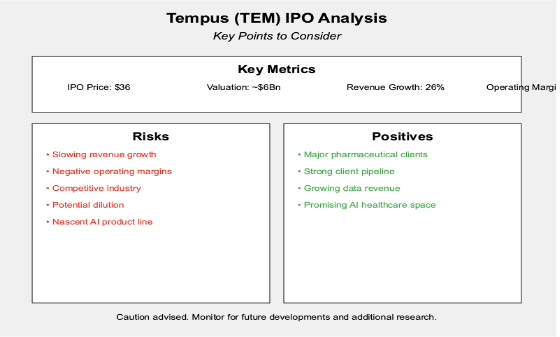

Tempus (TEM) IPO at $36

Key Risks

Revenue growth has slowed to 26% from 65% and likely to end the year at $650Mn.

The valuation is about $6Bn almost 10x sales with negative operating margins of 37%.

Gross margins are also lower this year than last year, which is a bad sign.

I won’t reject paying 10x sales if the growth is extremely strong, say over 40% but only 26% growth pre-IPO doesn’t inspire much confidence, especially when they’re so far from profitability.

Dilution Risk – in the first few years post IPO, cash will needed to fund losses and there will more dilution.

Very competitive industry – there are several large companies doing a combination of diagnostic revenue, data sales and getting paid for drug discovery milestones.

The AI product line is nascent – less than $3Mn in revenues in Q1-24.

Major investors – Softbank, Baillie Gifford, Google is a convertible note holder. Eric Lefkofsky – Founder, also co-founded Groupon and Mediaocean.

Positives

They do have major pharmaceutical clients – the roster is pretty impressive, and the pipeline is also strong. Some areas of promise – revenue from data has picked up, which can be more stable and sustainable.

To be sure, this is a very interesting and promising space and has a genuine need for AI related solutions. For now, I would be a little careful, there doesn’t seem to be enough growth, differentiation, or compelling reasons to invest, unless the price is really low. Wouldn’t want to get caught up in the first day euphoria. I’ll keep a lookout, there will be more research coming down the pike.