A Summary of Barron ’s interview with Savita Subramanian – head of U.S. equity and quantitative strategies at BofA Securities

Definitely one of the smarter strategists on Wall Street with a lot of prescient calls, especially being one of the first to raise the S&P 500 2024 target to 5,400, a level we passed yesterday.

https://www.barrons.com/articles/large-companies-value-stocks-market-rally-subramanian-21f7c4c2?mod=hp_LEADSUPP_1

“If I were going to buy one kind of investment for the next 12 to 24 months, it would be large-cap value. That’s where you’re going to get the most bang for your buck. That’s what will lead over the next few years, given the macro environment.”

“At the beginning of the year, it was much easier to be bullish because there were a lot more bears. And at this point, I feel like a lot of the bears have capitulated.”

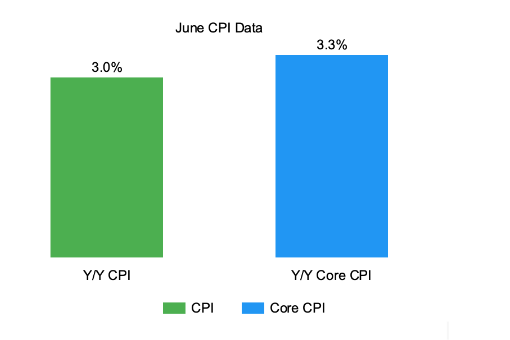

“I’m not worried about equities from a valuation perspective because these multiples are sustainable.” “Inflation volatility has subsided. This is where clients probably disagree with me the most, but I feel that what the Fed does now is less important because it has already done the extreme process of hiking.”

I agree with this to a great extent – interest rate cuts, higher for longer, neutral interest rates have a marginal impact. Directionally, the 10 year is moving lower, and except for shelter inflation, which has a variable called “notional rent” (A computed number based on what you would pay if you were renting your home today), a majority of other indicators have been moving lower.

” Until we get to that moment where the Fed says we’re at peak rates, inflation is coming down, and we can be more accommodative, you want to hold inflation-protected sectors such as energy, materials, and financials. These are more cyclical than defensive sectors.”

“When we were in more of an inflationary environment, we wrote about how the best environment for equities was 2% to 4% inflation. That’s where we are right now. The best environment for equities is when real wage growth is positive and nominal sales growth is at reasonable levels.”

A somewhat Goldilocks scenario…

“But I am surprised by how narrow the market has become. I would have expected a broadening out to have happened earlier.” “The earnings of the mega cap tech cohort are so high that we are more likely to see a deceleration than an acceleration. Another reason to expect a broadening out is that we got positive guidance across the board, and not just from tech companies, during first-quarter earnings season.”

“I like a mix of companies that are generating strong free cash flow and enjoying the benefits of this tech revolution, but also companies that are potentially becoming more labor light. If you think about the areas that could benefit from generative artificial intelligence, it’s banks, legal services, and IT [information technology] services.”

“And if you think about cash flow, it isn’t just tech but also utilities, power, infrastructure, and energy companies that are generating substantial amounts of cash. Some are exciting, and some are boring. But they are mostly big. That’s where I differ from a lot of other bulls. I don’t think you want to buy all small-caps, because while some of them are economically sensitive and will benefit from better gross-domestic-product growth in the U.S., others are morphing into smaller-cap companies because they used to be large.”

So be selective, the devil is in the details – cash flow, operational performance are paramount regardless of small, big, value, boring, tech – BUY THE BUSINESS, Buffet style..

When asked about the election – “The fact that both candidates agree that they want to bring back manufacturing from China and other regions of the world to the U.S. has created more jobs. While these policies are protectionist and inflationary, they are also pro-growth.”

“Right now is the most interesting time to be a market strategist, in my opinion. We’re back to a more rational market. When we were in a zero-interest-rate, massive-stimulus-driven market, it was hard to forecast what would happen next. Events were in the hands of central bankers.” “The outlook depends less on central bankers, and more on corporations and consumers.”

Its a very practical approach, and its folks like Savita, who are instrumental in allocating investment capital – this is not a theoretical, economists top down approach, which at the end of day is much less influential/meaningful for investors.