- Stubborn inflation and the fear of inflationary policies such as tariffs, budget deficits, and deportations had led to high 10-year treasury yields jumping to 4.8% before dropping to 4.66% today.

- This, in turn, has spooked the S&P 500, which gave up its entire post-election bounce before bouncing back today.

- The S&P 500’s current yield of 4.6% is less attractive compared to the 10-year treasury yield of 4.66%, questioning the risk-reward balance.

- However, while the 4.66% yield will compete for investors’ funds, patient investors who can stomach a correction should do much better scooping up high-quality bargains.

- There are enough positives to come from the new administration, such as lower taxes, less regulation, and business-friendly policies, which will trump the negative of high interest rates.

Will 10-year treasury yields of 4.66% drag down the market?

The equity risk premium

The current yield for the S&P 500 (NYSEARCA:SPY) is 4.6% or the 2025 Consensus Bottoms Up EPS of $274/S&P 500 of 5,953 = 4.6%. Comparatively, the 10-year treasury yield stands at 4.66% The commonsense argument is that if the US treasury gives me a risk-free return of 4.66% why should I make a risky equity index investment, yielding even less at 4.6%?

Risk-averse and conservative investors usually require a risk premium to invest in equities. During the great deflationary period from 2009, after the Great Financial Crisis, to Feb. 2020 (pre-pandemic), the equity premium was quite large as shown below. The average yield premium was 2.79%, and it rarely fell below 2%. The 10-year yield averaged 2.43%.

In an inflationary environment, with the 10-year at 4.66%, we’re getting a discount of 6 basis points or 0.06%, which begs the question

a) Either I should get a premium return for that risk or

b) I should pay less to increase my yield.

Stubborn inflation

With stubborn inflation, a reduction in yields looks unlikely, and many would patiently wait for the reduction in the index to get in at a decent price. Not surprisingly, as of Jan. 14th, we’ve given back almost all the Trump bump, falling to 5,800, a mere 0.5% from the Nov 5th election date close of 5,782, which has now bounced back to 5,953 following the better-than-expected CPI report.

Last September, I was confident that the Fed’s reduction of 0.5% would lead to a 10-year closing between 3.25% and 3.5% in 2025. At an earnings yield of 4.6%, that would have been a fairly decent premium of around 1.25%. Initially, it did drop to 3.6%; however, given sticky inflation readings in the next 3 months and a stronger-than-expected job market and economy, 10-year yields have gone the opposite way climbing to 4.79%, before dropping to 4.66% — leading to the Feds anticipating just two cuts in 2025 in their dot plot from the December 18th FOMC meeting. Four weeks later, the markets have taken a step further, anticipating just a paltry 27 basis points reduction in 2025.

This morning, on Jan. 15th, the CPI report was much better than expected, with core CPI coming in only 0.2% higher from a month earlier, – a drop after increasing 0.3% in each of the previous four months. Its YoY increase was only 3.2%, lower than 3.3% in November and below the 3.3% consensus.

The 10-year yield dropped to 4.66% – a huge 13 basis point drop, leading to a 1.7% increase in the S&P 500 by mid-afternoon to 5,5953.

The Fed’s December meeting minutes also revealed a Fed that was worried about higher inflation from the incoming administration’s tax and tariff policies, which contributed to their forecast of only 2 cuts in 2025. From the FOMC minutes:

Almost all participants judged that upside risks to the inflation outlook had increased.

The S&P 500 (SP500) dropped 1% on January 7th, when PMI data revealed persistent price increases on the services front. It dropped another 1.5% with the massive 256,000 gain in net new jobs created, with the non-farm payrolls released on January 10th. Price action in the treasury clearly confirms this worry and, given how fast traders have sold bonds, suggests that this could well continue. Market headlines blaming the weakness in stocks on bond yields have only increased. Simply, the markets are sanguine until they’re not, and then the dam breaks.

The incoming administration’s volatility premium

I also believe that traders are assigning a “volatility” or even a “drama” premium if you will. Markets hate uncertainty. If you’re a bond manager already facing three years out of the last four of losses, witnessing the bizarre behavior of our elected officials towards the end of the year of getting a simple budget extension is going to weigh on your decisions. Why buy the treasury at 4.79% when the yield could shoot through 5.5% if there is more drama getting anything done in Washington with a razor-thin majority and an executive branch executing through Twitter?

An emboldened Trump, with a penchant for implausible actions such as annexing Greenland and the Panama Canal, will only increase bond market jitters.

High interest rates hurt Main Street, not just the market

The other factor that worries me about rising interest rates is the higher interest burden on other sectors such as commercial real estate lending, and residential mortgages. Residential mortgage rates are over 7% now, and while over 92% of residential mortgages are at much lower fixed rates, I would think that a significant amount of home purchases (some of which were chasing high-priced homes in short supply due to inventory shortages) have been made at higher mortgage rates in the last two-three years with the hope that they could refinance at cheaper rates – and clearly that hasn’t happened in 2023, and 2024 and from the looks of it, very unlikely to happen in 2025.

Similarly, the commercial real estate market is also likely to face problems.

According to Trepp estimates, roughly $1.7 trillion, or nearly 30% of outstanding debt, is expected to mature from 2024 to 2026. This is commonly referred to as the “maturity wall.” CRE debt relies heavily on refinancing; therefore, most of this debt is going to need to be repriced during this time.

The 4.5% yield threshold

Source: The 4.5% yield threshold (Bloomberg, FactSet, Morgan Stanley Research, The Heisenberg Report)

Last April the S&P 500 P/E fell in tandem with the 10-year rise, and it currently looks to be following the same path, not auguring well for the market in 2025.

Could we get “Trussed”?

UK 10-year bond yields surged by 30 basis points on January 8th, to 4.925%, bringing back bad memories of the harrowing 49 days of Elizabeth Truss’s short-lived premiership in 2022.

Back then, Truss had made the mistake of unveiling an unfunded budget of 45Bn GBP of tax cuts when inflation rates were about 11%! UK Equity, Bond, and Currency markets sank, with many even suggesting that the UK government’s treasury was no better than that of a Third World country. Almost destroying a weak Gilt market ultimately led to her resignation.

Fast-forward to 2025 – the 30 basis point drop to a level not seen since 2008 has 2 repercussions. 1) Bond markets are reacting very strongly to governments not having enough control over their country’s inflation. Punishment was swift and severe. It was the 4th day of drops in the UK bond market.

2) The second repercussion, and what worries me; is this going to happen in the US market as well as the incoming administration starts working on their planned tariff hikes, which will increase inflation; if so, where does the yield stop?

Tax cuts can be inflationary

Trump’s proposed tax cuts reduce tax revenues and increase deficits, which is inflationary.

The incoming administration plans to extend the 2017 tax reductions, reduce the corporate tax rate, and decrease or eliminate taxes on certain types of income. Here is the analysis from taxfoundation.org:

Using the Tax Foundation’s General Equilibrium Model, we estimate Trump’s tax proposals would increase long-run GDP by 0.8 percent, the capital stock by 1.7 percent, wages by 0.8 percent, and employment by 597,000 full-time equivalent jobs.”

“We estimate the proposals would increase the 10-year budget deficit by $3 trillion conventionally and $2.5 trillion dynamically. The debt-to-GDP ratio would increase from its long-run projected level of 201.2 percent to 223.1 percent on a conventional basis and 217 percent on a dynamic basis. Increased deficits and a higher debt load would require higher interest payments on the debt that would reduce American incomes as measured by GNP by almost 0.8 percent; the higher interest payments drive a wedge between the long-run effect on output of 0.8 percent and the long-run effect on GNP of -0.1 percent.

As you can see above, the repercussions can be good for the economy with higher GDP, but it will also be inflationary and expensive to service with higher interest rates. What’s also significant is that the administration believes that they can make up the shortfall by increasing tariffs, which in my opinion will worsen an already high inflation rate.

What the bulls say: There are a lot of positive factors as well

Juxtaposed with the negativity of high interest rates are the positive effects of excellent earnings growth from the S&P 500, lower taxes, and less regulation.

Source: S&P 500 Earnings (FactSet)

FactSet’s estimates call for a strong 14.64% growth in the S&P 500 for 2025 to 274.19, followed by 13.6% growth to 311.44 in 2025. In the years that I’ve been using FactSet, I’ve seen that the variation is not significant for the index. I strongly believe that the S&P 500 earnings would come in between 267 and 281, with an error margin of just 2.5%. But the problem is not in the performance – it’s the valuation, we’re priced to perfection as seen below, and disappointments could be the main catalyst for a drop.

Source: S&P 500 P/E Ratios (The Heisenberg Report, Datastream)

The last time the S&P 500 P/E was above 20, the 10-year was around 2%, currently, we’re at a P/E of over 21.73, but the 10-year is at 4.66%.

Corporate Debt is doing fine

Credit default risk is low among corporate borrowers as per a Goldman Sachs report.

Good earnings and cash flow over the last few years have led to low debts on several investment grade and lower balance sheets. The level of fallen angels – or companies below investment grade, is at its lowest level in 25 years.

Risk premiums are not mandatory for equity investments

The lack of an equity risk premium is not the end of the world and as we can see from the chart below, in higher interest rate environments from 1985 to 2000, there never was one. The biggest premiums have been in the deflationary era, post the GFC from 2009 before the Fed started raising interest rates to quell inflation.

Source: Equity Risk Premium (Fountainhead, Yahoo Finance)

A high interest rate doesn’t kill the equity market just because of a lack of a risk premium, but it provides competing offerings at much lower risk, and we saw that hurt the equity market in 2022 when the Fed started raising interest rates aggressively to contain inflation. I, myself, put money in high-yield CDs and corporate bonds through 2023.

A 5% Treasury yield should attract buyers

I believe there could be a lot of buying if the treasury breaches 5%. In October 2023, when the Middle East conflict was raging, bond yields briefly touched 5% from where they reversed very steeply, on buying and a subtle push from Treasury Secretary Janet Yellen, who reduced the size of government auctions by $76Bn. Will history be repeated? I think it’s likely that there will be substantial buying of 5% treasury bonds, as do several analysts, and money managers.

Inflation: The worst is likely behind us

The PPI came in a little lower than expected at 0.2% M/M in December 2024, versus a consensus of +0.4% and November’s reading of +0.4%. Even better, the core PPI was flat M/M, significantly lower than the expected rise of 0.3%. The benign numbers triggered a relief rally on Jan. 14th, and the CPI report which came in today (Jan 15th, 2025), did even better with the core CPI beating estimates, leading to a drop of 13 basis points in the 10-year and a huge 1.7% gain in the S&P 500. This could be the beginning of a trend reversal.

Positive effects of lower taxes

Even as we move towards a more inflationary environment with unfunded tax cuts, the Tax Foundation believes that lower taxes would increase long-run GDP by 0.8 percent, capital stock by 1.7 percent, wages by 0.8 percent, and employment by 597,000 full-time equivalent jobs.

Rekindled animal spirits are great for Main Street

Small businesses, which are major employers and contributors to US GDP, are very optimistic about the Trump administration’s policies, which should augur well for the economy. Small businesses are notably excited about higher sales, less regulation, increased chances of finding high-quality labor, stabilizing inflation or price increases, and importantly, better credit conditions due to less regulation. Not surprisingly, the groups’ uncertainty indicator has dropped as well.

What is the best way forward to invest in a difficult year?

Keep realistic expectations

There are enough bullish and bearish factors without either one having a clear edge. In 2023, the S&P had a reasonable P/E of around 18, allowing the big AI bang from Nvidia’s May earnings report, to propel the index to a 24% gain. In 2024, the S&P 500 gained 23% as the AI trend continued, but now inflation has persisted and the S&P trades at an expensive 21.7 times 2025 forward earnings. The chances of a third year of 20% gains are rare; it’s happened only 3 times in the past 100 years, but two of those were in 1935, and 1936 following the great depression, and then the third one in the nineties during the dot-com bubble. So, my expectations have to be very realistic.

Wait for bargains

The correction should continue, which allows us to scoop up bargains: In my opinion, we’re likely to see 5,500 before 6,500 in 2025. The S&P had wiped out the post-election bump, dropping to 5,800, past the 20 and 50 DMAs, before reversing this morning. Should it drop again, I expect strong support around its 200 DMA of 5,582.

Besides, I think this market will continue to correct until interest rates stabilize, which won’t happen until we see a drop in PCE readings (due at the end of January) wage growth, and a reduction in volatility, which is high with the VIX hovering between 17 and 19. There’s also precious little one can do about volatility; this is a Presidential stock-in-trade. The first few weeks of the Trump administration should be fairly volatile, as they roll out their tariff, deportation, and tax plans. The incoming President has stated that they intend to get off the ground very quickly with executive orders on day one, with immigration a big priority, which means we should get a fairly good view of deportations and their inflationary effects. The Trump administration also showed in their previous innings, firing unrealistic salvos as opening bids – and thus I assume a zero chance of 60% tariffs – the realistic number is likely to be much lower, but the drama will unsettle the market.

Focus on the big picture and stick to the fundamentals

To me, the biggest investment factor is always the fundamentals of great companies, which trumps macro, economic, or technical factors in the long run, unless they’ve historically deviated from the norm, and we’re not anywhere close to that. The stellar jobs report for December confirms how strong the economy is, in fact, higher wages are your biggest defense against inflation – good news is good news. It’s idiotic to hope that the labor market weakens, so the Fed can cut rates – very twisted logic, which hopes for weakness in the economy!

Earnings

Earnings will continue to do well, as we saw from FactSet’s estimates and especially across the M-7; No matter how much we complain about the lack of breadth, the M-7 will still carry the economy and the markets. The M-7 are not outliers, they are truly entrenched in the economy and are in the rare, sweet spot of being secular and sustainable growers and stalwarts with strong brands, pricing power, and huge moats.

Stocks to buy on declines

Taiwan Semiconductor Manufacturing Company Limited (TSM) – I first recommended TSMC in August 2023, and continue to add on declines. Its December monthly revenue grew 58% YoY and fourth quarter revenue grew 39% YoY, suggesting a strong beat of its mid-point guidance, and confirming its strength as one of the strongest pillars of the semiconductor industry.

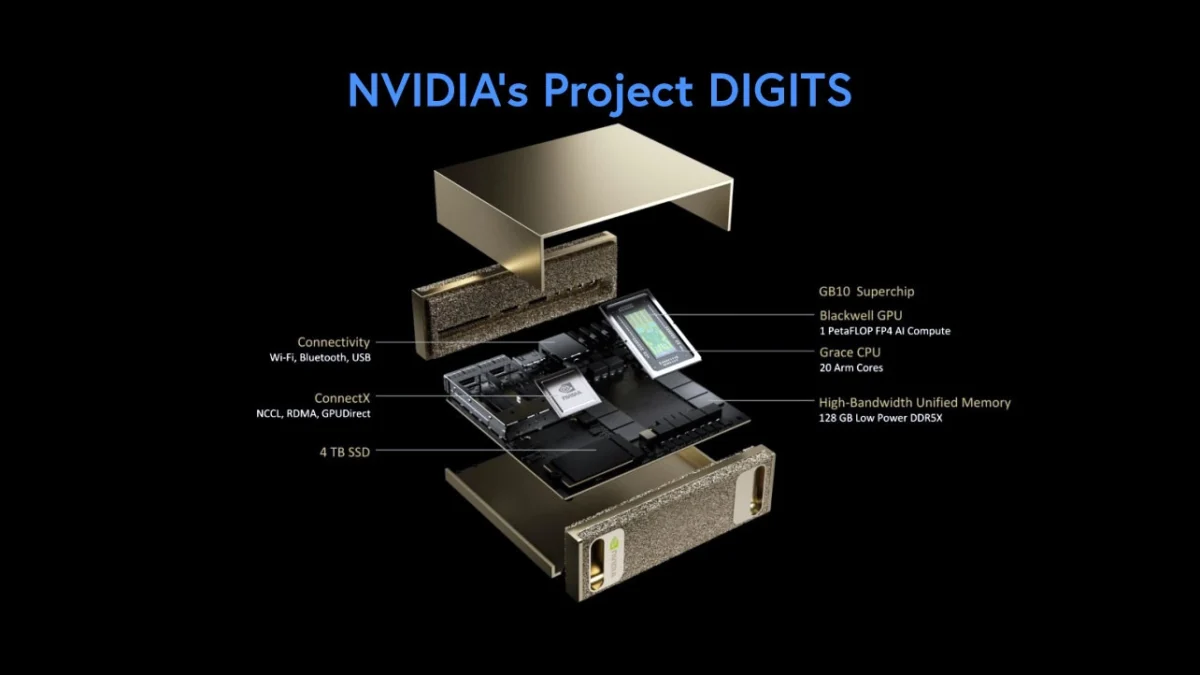

NVIDIA Corporation (NVDA) – The CES showcased a strong Nvidia with its foray into the PC market, its new gaming chips, and the introduction of Cosmos, which takes its Ominverse segment to much higher levels with the addition of Blackwell architecture. Any short-term thinking about Blackwell delivery delays is just noise and a great opportunity. I’ve started buying around $132 and will continue to add on declines. I’ve owned Nvidia for a long time and have recommended it in March 2023, and July 2023.

Alphabet Inc. (GOOG) (GOOGL) does not get enough recognition for its market leadership and moats in Search, YouTube, Google Cloud, and Waymo, with far too much focus on the antitrust ruling. Given the new administration’s anti-regulatory stance, I don’t believe Alphabet will be hurt as badly, and even in the worst case, here’s a sum of the parts valuation, which at $2.6Tr is higher than its current market value of $2.35Tr.

I would also add the following on declines: Duolingo, Inc. (DUOL), the market leader in language learning and a huge beneficiary of AI, Marvell Technology, Inc. (MRVL), which has a strong position in ASICs and is very attractive at 12 times sales growing at 40%, and 41 times earnings growing at 33%,

Corrections are healthy for the market, and I look forward to buying on declines.