Author: Fountainhead

Alibaba (BABA) $74, JD.com (JD) $24

At $74, Alibaba does seem like it’s at a rock bottom valuation with 7-8% earnings growth priced at only 8.5x earnings and sales growth of 7% priced at only 1.3x sales. Similarly, at $24, JD is even cheaper at 8x earnings for a 12% grower and 0.3x sales for a 4-5% grower, which is also below its historical average.

But, I suspect given the China risks in the future, low multiples are par for the course. For many, China’s authoritarian impulses such as Jack Ma’s treatment, clampdowns on businesses, on Hong Kong, during the pandemic to name a few, plus supply chain problems, are a strict no-no for further investments. Ironically, a real Chinese wall for investors.

Perhaps low multiples are the new normal for China, so not sure what yardstick or benchmarks to use – or what is the level of discount needed for country/political risk? The deflationary spiral, and decrease in demand is real and not transitory, with no easy fixes – extorting businesses and investors to invest or banks to lend never has good endings, and I’m not saying that with just a philosophical bias. I also cannot see government policies easing, either.

That said, both these businesses are doing all right and will continue to recover over time – I can’t figure out whether investors will re-enter or will give Chinese companies a better valuation. I don’t have any Chinese stocks, so can’t opine – that country/political risk call you’ll have to take.

The anomaly of interest rate movements

- Are markets not believing the Fed?

- The 10 year treasury dropped from a high of 4.195 on 1/25 to 3.942 today, 01/31 – the day the Feds and Chair Powell was clearly signaling no chances of a rate cut at the March Fed meeting.

- Intuitively the yields should have gone up – is there something else at play.

- I believe Yellen’s dovish nod on 1/29 was the main catalyst for the drop in rates and clearly that seems to be overriding Chair Powell’s comments after the FOMC meeting.

Simply, if the government decides it needs to borrow more, it doesn’t get to borrow at cheap rates; the private sector will naturally charge more, which means interest rates go up. Now if Powell’s boss signals that borrowing will be a) less than anticipated this quarter b) borrowing intervals and amounts will be regularly spaced out, it’s a clear dovish signal that the government doesn’t want interest rates going up in an election year.

BJ’s had been a decent performer, starting from the $40’s range in 2020, to $65. (A lot of it Covid outperformance)

That’s about 16% per year. Though in the past year, BJ’s has had a negative return of 10%.

Currently it’s priced at 15x earnings with forward estimates of 5-6% in earnings and 4-6% in revenues, so that’s a Price to Earnings Ratio (P/E) of 15, with growth of 5, that’s a PEG ratio (P/E to Growth) of 3, which is high. I normally try not to pay more than 2, unless there is really superior growth. Not likely in this sector.

Contrast that with closest competitor Costco, which has earnings growth of 10 to 11% but at a P/E of 35 and – that’s even more expensive!

That said, Costco is a far superior business, with more stable margins, operating efficiencies and scale, which attracts both high volume sellers and customers. Costco is about 10X BJ’s and both started out around the same time. BJ’s unlikely to take market share from Costco,

Bottom line – If the stock becomes a bargain around $55 I could see it returning around 7-8% a year. On the other hand a company like this doesn’t fall as much in bad times, it’s a low risk stock.

From 2017 to 2021, Upstart grew at a frenetic pace of 70%, before higher interest rates, funding constraints and higher defaults led to a massive decline in revenue.

Upstart was supposed to be an agnostic “Fintech” marketplace without credit exposure, but they made the mistake of taking auto loans on their books, which completely negated the buying/bullish case.

Upstart has boosted its capital but even at its latest earnings call, management stated Upstart’s ability to approve borrowers is constrained due to a macroeconomic environment of low consumer savings and high credit default rates.

Right now revenue growth forecasts are low and there are no clear indications of a turnaround – sure lower interest rates and better participation from banks and other financial institutions could be tailwinds in the second half.

Interestingly, while researching this one, I looked at Sofi Technologies (SOFI) and Pagaya (PGY), which are in much better shape, much more resilient and could be winners. Pagaya has executed well in the high interest rate downturn. Both are on the riskier side, and I will update later today.

Teradyne’s guidance was a big disappointment – they’re forecasting zero growth for 2024, mainly because the first two quarters will be lower but growth will pick up in Q3, Q4. Consensus estimates were for 10% growth in 2024.

Even as end clients like Cloud Service Providers and hyperscalers have bought more semiconductors in the last 6 months, capacity utilization of Teradyne’s testing equipment is still low and new buying of equipment will not be triggered till capacity is used up. This isn’t always a linear relationship, and often there are lags. Second – mobile and PC’s markets have also not increased demand and Teradyne will not get visibility till April for mobile phones demand (read Apple via TSM, which is their largest customer).

Management believes that there is little downside left, and they see utilization rates improving and unit growth in PC’s and smartphones could be a tailwind in the second half. They are still maintaining 2026 estimates of $4.3Mn and over $6 in EPS, but they have a lot of catching up to do.

Contrast this with closest competitor, Advantest (ATEYY), which surprised this morning and increased guidance by 2-3% for the next quarter.. They’re expecting a great second half as well.

I have more Advantest than Teradyne and it’s also done much better for me. If things don’t improve at Teradyne I may just focus on Advantest.

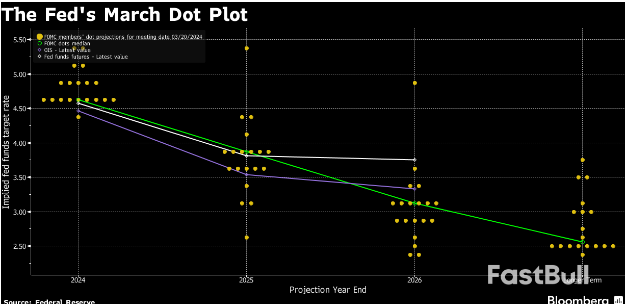

Fed rate cut not likely in March

Inflation has eased from its highs without a significant increase in unemployment— “that is very good news,” Federal Reserve Chair Jerome Powell said Wednesday after the central bank kept its policy rate unchanged for the fourth straight meeting. But he followed that up with inflation still remains above the Fed’s 2% goal. “We need more evidence to confirm what we think we’re seeing,” Powell said.

It will likely be appropriate to dial back the Fed’s policy rate at some point this year, he said.

Powell repeats that the Fed will move “carefully” in considering when to cut rates. He doesn’t think that the FOMC is likely to cut at the March meeting.

While he sees some risk that inflation reaccelerates, “the greater risk is that inflation will stabilize at a rate over 2%.”

He declined to say the economy has achieved a soft landing. “We’re not declaring victory at this point. We have a ways to go.”

“There was no proposal to cut rates,” Powell said. Some members did discuss their rate path. Also, he said there was a broad range of views.

“If we saw an unexpected weakening in the labor market, that would weigh on cutting sooner.”

Great Expectations. Hi everyone. Sometimes, stocks get ahead of themselves.

Late Tuesday, three of the biggest names in technology—Alphabet, Microsoft, and Advanced Micro Devices—reported December quarter results and offered the latest updates on their AI progress.

While the headline numbers were generally solid, they weren’t good enough to impress investors given the stocks’ big runs.

Microsoft had the best quarter of the bunch, reporting earnings per share of $2.93, well ahead of the analyst consensus of $2.76. Alphabet beat profit estimates, posting EPS of $1.64 versus the consensus of $1.59. AMD’s profit was in line with the estimates, but the company’s revenue outlook was disappointing.

All three stocks were down in mid-day trading Wednesday. Alphabet shares dropped 6%, AMD slipped 3%, and Microsoft was down 1.4%. The tech-heavy Nasdaq Composite was off 1.6%.

The main problem with the reports wasn’t the numbers but the expectations going in. Take AMD’s AI chip outlook. On last night’s conference call with investors, CEO Lisa Su said that AMD now expects revenue for its AI data center MI300 GPU products to surpass $3.5 billion in 2024—up from a $2 billion forecast just three months ago. While the guidance is up significantly, some Wall Street analysts had estimates of up to $8 billion.

Investors would be wise to largely overlook these day-to-day stock movements. The technology companies’ conviction over future AI demand is more important. And, given the latest commentary about capital expenditure budgets, the robust trend is intact.

Microsoft said its expects capex to “increase materially” in the current quarter, and it intends to invest aggressively in the coming quarters. Alphabet said its capex would be “notably larger” in 2024 versus the prior year. Both companies said infrastructure investments are being driven by trends in AI demand.

There’s other evidence the AI arms race is still on beyond the comments from Microsoft and Alphabet. On Monday, Super Micro—a leading independent manufacturer of high-end AI servers for data centers— easily beat expectations and raised its full-year revenue guidance by nearly 40%. Last week, Nvidia CEO Jensen Huang told reporters in Taiwan that demand for AI GPUs is still outstripping supply, while adding 2024 is going to be a “huge year.”

Finally, Meta CEO Mark Zuckerberg boasted on social media earlier this month that his company will have 350,000 Nvidia H100 GPUs—and almost 600,000 H100 equivalent GPUs based on total computing power—by the end of this year.

We’ll find out more when Meta, Amazon, and Apple report on Thursday, but all signs suggest that AI spending is still accelerating—no matter what stocks said on Wednesday.

Qualcomm (NASDAQ:QCOM) shares rose 2.7% in extended trading on Wednesday after the semiconductor company reported fiscal first-quarter results and guidance that topped expectations.

For the period ending Dec. 24, Qualcomm earned $2.75 per share on $9.92B V consensus estimates of $2.37 per share on $9.52B in revenue.

QCT revenue rose 7% year-over-year to $8.4B.

Revenue from handsets rose 16% year-over-year to $6.69B

Automotive sales jumped 31% to $598M. – this will be Qualcomm’s biggest growth catalyst.

Sales from IoT plunged 32% to $1.13B.

Licensing revenue fell 4% year-over-year to $1.46B.

Revenue and Earnings Midpoint Guidance is higher at$9.3Bn and $2.3 for the next quarter.

Qualcomm said it expects to earn between $2.20 and $2.40 per share, with revenue forecast between $8.9B and $9.7B. Analysts were expecting $2.25 per share in earnings and $9.28B in revenue.

Teradyne reports Q4-23 earnings after the market today.

TSM is Teradyne’s biggest customer for its semiconductor testing equipment, and its bullish guidance of 20-25% growth for 2024 is a big plus for Teradyne; especially after Teradyne’s two years of declining sales and earnings, a lot of which was pandemic indigestion and the slow rollout of the N3 process node from TSM in 2023. However, N3 production and delivery is going to expand tremendously in 2024 and 2025 and will spur demand for Teradyne’s testing equipment.

This probably will not be evident in 2023 Q4 results. Q4 expectations are low – only $0.67 in EPS and $675Mn in revenues, and for the full year 2023 are $2.70 in EPS and 2.67Bn in sales. In my opinion, consensus earnings and revenues for 2024 are too low at $3.64 and $3Bn in sales – instead, *I believe earnings will be between $4 to $4.25, and sales over $3.2Bn*. Teradyne has good operating leverage and earnings should grow to over $6 by 2025. *That’s over 40% earnings growth for the next two years.*