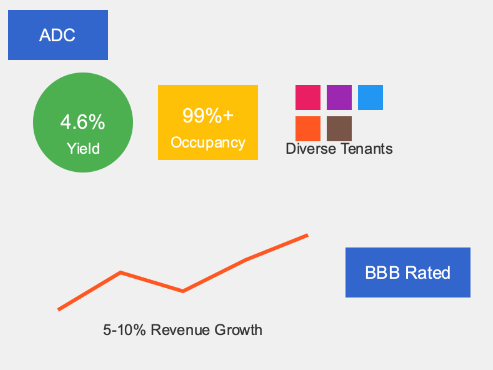

gree Realty Corporation (ADC) – Buy $61 REIT (Real Estate Investment Trust) Dividend Yield 4.6%.

- Consistently higher than 99% occupancy, diverse set of retail clients.

- Investment grade tenants, Agree’s debt rating is BBB Investment grade

- Well diversified tenants – groceries, auto, restaurants, big box and convenience stores

- Borrows at a spread of 1% above treasury, interest rate cuts are going to help debt renewals in 2025 and beyond.

- Forward growth estimates of 5-10% for total revenues

Agree is valued at 15 times Adjusted FFO (Funds from operations) – higher than the market average of 12-13. FFO is a better measure than Earnings for realty companies. Agree’s FFO growth is estimated higher as well, as is the payout to shareholders so the yield will actually get better.

In Agree’s case the stock has actually remained flat over 1 year in spite of higher interest rates and all the action being focused on tech. In the past 5 years it returned 3% but in the last 10 over 124%, so with the dividends this has been quite a good performer. The other risk is that 50% of its business is concentrated in 10 states, but the states are diverse from the sunbelt to the Northeast.