Trade Alert – Bought Netflix (NFLX) $640 Pre Market

Q2 – Earnings update

I was impressed

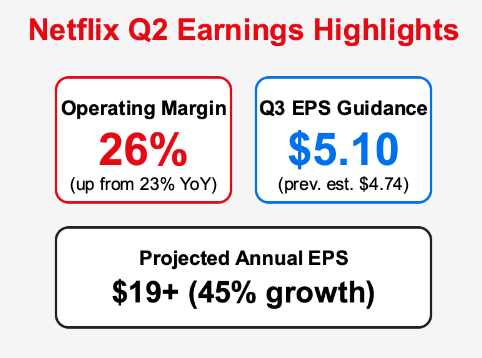

a) With the increase in operating margins to 26% from 23%, YoY.

b) The Q3-24 earnings guidance of $5.10, higher than the earlier $4.74 estimate.

This translates to an EPS of over $19 for the year, a 45% growth. At this rate the 4 year forward earnings growth is going to exceed 27%, higher than the 25% I had forecasted earlier.

I had bought and recommended Netflix on April 22nd at $555 as an earnings growth story. My investment thesis is that the streaming market had become saturated and overcrowded, and it becomes difficult for households to exceed 3 subscriptions and/or go beyond a budget of $45 per month. That actually helps Netflix with its first mover advantage, making it the entrenched gatekeeper to your TV, with studios and other streaming services clamoring to partner with it. Take Suits and The Office as examples of older shows partnering with Netflix and increasing their viewership by leaps the second time around! Their reach is a big competitive advantage for them.

I was surprised by the market’s knee jerk lack of appreciation – which is an opportunity. Advertising growth is not as fast or strong enough seems to be the reason for the initial decline. I believe advertising will be a strong pillar but I never expected it to be a fast growing segment. It will take time.

On 6/20, I had sold 20% around $687 as profit taking and I’m going to buy it all back at around these prices.

I had written a detailed article on SA on Netflix. – here’s the link.

https://seekingalpha.com/article/4677048-netflix-has-a-deep-moat-with-its-virtuous-circle