An interesting article in the Wall Street Journal discusses Google’s anti-trust case in more detail. Quoting from the article:

“Some of the DOJ’s proposals were expected, such as the divestiture of the Chrome browser and a ban on payments to Apple AAPL in exchange for default or preferred placement of Google’s search engine on Apple’s devices”, which are minor and something Google could take in its stride.

But the government’s proposal of “Restoring Competition Through Syndication And Data Access”, could be more harmful in the long run.

Restoring competition through access, which involves Google providing its search index—essentially the massive database it has about all sites on the web—to rivals and potential rivals at a “marginal cost.”, in my opinion, is stripping Google of its IP, and competitive advantages, which it has built through decades of human and monetary capital. It is draconian and a massive overreach. It gets worse, if the government has its way, Google would also have to give those same parties full access to user and advertising data at no charge for 10 years.

For now, it’s a wish list, a starting point of a high ask, which I’m sure the government expects to be whittled down to something less harmful and gives it some bragging rights.

Points to consider

- This could harm/scare other tech giants.

- The Turney Act makes this government agnostic, it guarantees judicial oversights for antitrust actions.

- Alphabet has significant and solid resources and defensible arguments to fight this, mainly the 2 decades of resources put into building this moat.

- The stock is likely to stay range-bound or sideways because of the legal issues, where most investors would likely be cautious, even though this morning itself there have been strong buy calls from analysts.

I’m definitely going to hold on. While it is bad news that the DOJ is recommending that Google be forced to sell Chrome, it’s not written in stone, and there’s a small likelihood of it actually happening.

Here are several aspects to consider.

The Chrome divestiture is not devastating: Chrome, if divested could be valued at an estimated $20Bn, according to Bloomberg Intelligence, about 1% of Alphabet’s market cap of $2Tr, so it’s relatively less harmful.

All Roads Lead To Google Search: Even if the spinoff did happen, that doesn’t mean users would ditch Google’s search engine for rivals such as Bing and Safari, which account for less than 15% of the overall market.

The judge is unlikely to take up the recommendation: There is also the possibility the breakup doesn’t happen. Judge Amit Mehta, who will address Google’s illegal monopolization, could follow precedent.

“I think it’s unlikely because Judge Mehta is a very by-the-book kind of judge, and while breakups are a possible remedy under the antitrust laws, they have been generally disfavored over the last 40 years,” said Rebecca Haw Allensworth, a professor and associate dean for research at Vanderbilt Law School, in an email Monday. “He is very interested in following precedent, as was clear from his merits opinion in August, and the most relevant precedent here is Microsoft.”

The chances of an appeal are very strong: In June 2000, a judge ordered the breakup of Microsoft but that decision was later reversed on appeal. Google has stated that would appeal vigorously.

One of the analysts I follow had a fair point about some of Google’s “predatory or abusive” tactics on their ad-tech platforms, for which there are guidelines/rules that can be enforced for specific violations. But to get into a “European” mindset about regulating companies just because they have strong competitive advantages/moats is completely wrong, in my opinion. If Google didn’t pay Apple $20Bn to be its default search engine, Apple users would still prefer Google Search to Safari or Bing – this was in the court documents. Penalizing them (Google) is a massive overreach.

Google built this from scratch with tons of human and financial capital, at a time when there were several larger search engines in a fledgling, growing internet. The iPhone explosion came later. I would be very surprised if the government succeeds in destroying Alphabet.

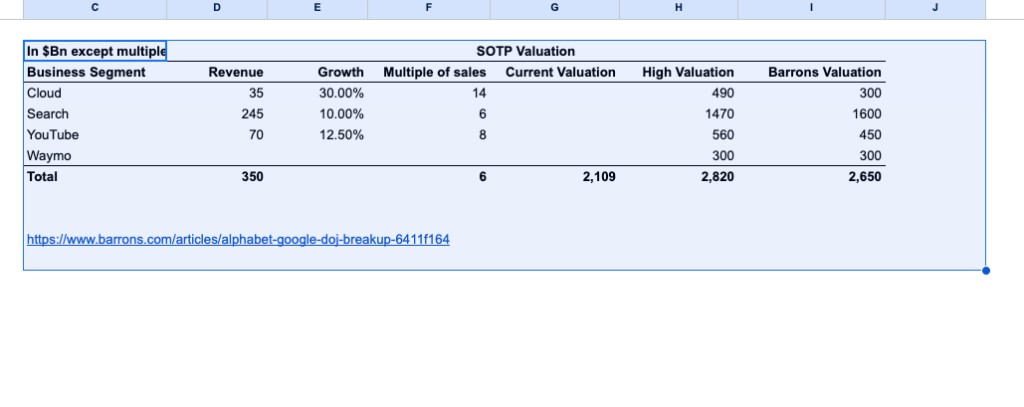

Here is a sum of the parts valuation, which based on these estimates gives Google a higher valuation than its current market cap of $2.1Tr

One reply on “Alphabet (GOOG) $165, Beset By Legal Issues Could Stay Range-Bound”

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.