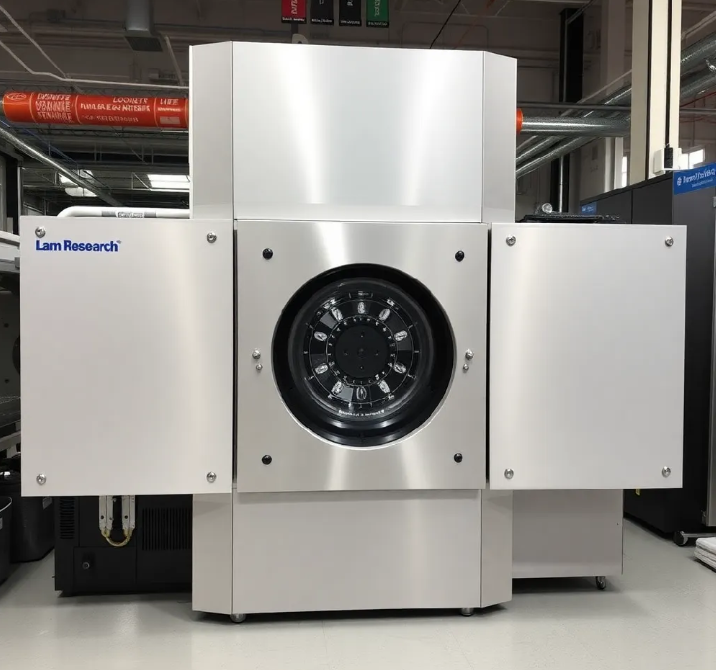

Lam Research (LRCX) $975 – Semiconductor equipment leader,

Trade Alert – Bought Lam Research (LRCX) $972

I’m late in buying it, I should have bought and recommended it when I bought Micron (MU) last year. The stock is already up some 90% in the past twelve months, but I think there is a lot of gas still left in the tank.

Even with semiconductor cyclical fluctuations, Lam Research has performed like a secular growth stalwart, with an EPS CAGR of 28% in the last 10 years – most secular growth companies don’t have that kind of profit growth.

It has market leadership in two segments of wafer equipment manufacturing and should keep that – Applied Materials is the closest competitor, and their forecasted growth is about ½ of Lam’s 15% forward growth. Continued demand from AI expansion augurs well for Lam’s future – they supply equipment to both TSM and Micron.

Lam Research is expensive, but with a forecasted 3-year revenue CAGR of 15%, and EPS growth of 21% it is worth buying during market pullbacks. I just started nibbling and with the 10-year yield shooting up to 4.6%, there will be more opportunities to buy on declines.

Here is the link to the article.